Welcome back to another installment of New Year, New Challenges, where we lay out some of the biggest changes our clients and readers can expect to see in their given field as our planet starts its next lap around the Sun. Our topic this week: manufacturing trends.

Earlier, we took a look at each of the major industries our clients deal in, such as HVAC, building materials, and so on. Now, we’re getting a bit more general about it and are looking at two major camps: people who sell stuff and people who make stuff. Also known as distributors and manufacturers if you want to get all technical about it.

As we continue to deal with the disruption brought on by COVID-19, both of these groups are looking for ways to return to the pre-pandemic levels of prosperity that we’d closed out the previous decade with. But we’ll come back to distributors later—for now, let’s take a look at trends for manufacturers, breaking things down into three major categories of impact: process, people, and product.

Process: Resilience and Robots

It’s been a tough couple years for the industry, but the real economic impact the pandemic has caused is leading manufacturers to look at how they can become more resilient and adaptive, and in many cases that means that artificial intelligence and IoT are increasingly finding their way onto the factory floor.

I know in the past this blog has engaged in some lighthearted panic about how the robots are definitely taking over the world, and while I’m still one hundred percent terrified about that, some aspects of this evolution are undeniably positive for businesses and workers and creating helpful manufacturing trends.

Incorporating AI and other “smart” tech into manufacturing processes helps maximize efficiency and safety on the job (especially important given COVID concerns) and even offers predictive maintenance for machinery. In its 2021 Manufacturing Industry Outlook, Deloitte noted that manufacturers are looking for innovative ways to protect their businesses against disruptions, such as shoring up digital infrastructure or finding new ways to gain intel on the health of their supply chains.

As always, this change is a process, not an overnight transformation. In its yearly industry report, the British publication The Manufacturer reported that 81% of UK manufacturers believe that incorporating digital technology into the factory will enable business growth across the board – though it noted that plenty of small- and mid-size companies are unsure of how best to accomplish this goal.

While the proliferation of IoT and Industry 4.0 might seem like a nonstop marathon of avoiding obsolescence, the new technologies offer the stuff-makers at least one major new advantage: data. You might think of data analytics as a distributor’s game, but IoT systems also provide invaluable information to manufacturers about how their end users are buying and interacting with their product. This allows them to more quickly adjust to market demands and changing tastes, rather than having to simply go off last year’s numbers. Just make sure to use all that information responsibly, or it can lead to some major discomfort among your end users.

People: Shortages and Transformations

Labor shortages continue to be a significant challenge in the manufacturing industry. Even amid downsizing brought on by the pandemic and the increasing automation of the manufacturing floor, manufacturers are experiencing a serious talent scarcity, with an expected 2.1 million jobs unfilled by 2030.

It’s a bit of a perfect storm: Baby Boomers, the formerly largest generation, are retiring, the younger generations are generally less inclined towards trade jobs, and to top it all off, we’ve got this pesky pandemic making in-person work of all kinds less attractive. Not great conditions for hiring on the manufacturing floor.

A recent survey by Deloitte found that 38 percent of manufacturing executives saw hiring new workers as a top workforce priority for 2022, with retention (31 percent) and reskilling (13 percent) also prioritized. Deloitte highlights the need for businesses to reshape the image of the manufacturing industry to entice younger generations of workers: “Placing a spotlight on modern facilities, advanced technologies, career mobility, well-being, and purpose can further attract new entrants, re-entrants, and those reconsidering employment changes.”

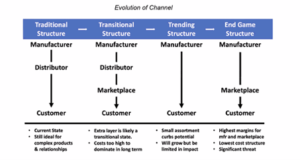

There’s also the ongoing transformation of the sales force, both for manufacturers and distributors. Manufacturers have a choice to make moving forward: stick with what’s always worked, or dump distributors (in some capacity) and connect directly with end users.

In the chart below, put together by Distribution Strategy Group, we see the new and growing trends for manufacturer distribution.

Going DTC (direct-to-consumer) can seem like an attractive option moving forward for a number of reasons. Cutting out the third party doesn’t just have the potential to raise your profit margins, it puts you in direct contact with your end user, which can offer you major insights into how your product is being bought and used. Sounds like a pretty good deal, and, in fact, Forrester predicts that indirect sales will decrease every year for the next decade in favor of the marketplace model like Amazon’s.

Product: High Expectations and Bottlenecks

When it comes to what gets made – and how it gets to the end user – expectations are higher than ever. If there’s one thing we don’t need to tell you, it’s that innovation is the name of the game. As the world plunges headfirst into the Fourth Industrial Revolution, or Industry 4.0 to use its more modern name, the pressure is on for manufacturers to continually evolve and upgrade their products to fit end user demands, distributor expectations, and manufacturing trends.

We can probably tie this trend to personal biases arising from consumer behaviors: in their lives as consumers, decisionmakers in companies are used to everything being streamlined. If you want to watch a new movie, it’s right there on one of your streaming services. If you want literally any product, you can just go over to Amazon and buy it with a single click and wait for it to be delivered to your door in a couple of days. That speed and ease affects expectations in the business world: thanks to technological development, distributors and end users are increasingly expecting fast, streamlined experiences from their channel partners.

Unfortunately, it’s been a bit difficult to meet those high expectations and high demand. It will hardly surprise you to hear that supply chain disruption is one of our biggest anticipated trends for the new year. Global manufacturing and distribution supply chains are a finely tuned machine that depend on every link to function properly, and with COVID variants continuing to move through the Greek alphabet this challenge is probably going to stick around for a while, even if the bottleneck isn’t quite as dire as it was last summer, at the height of the delta variant.

What this means is that manufacturers will need to get creative about how they fortify their supply chains for the future. Deloitte has identified “overreliance on low inventories, rationalization of suppliers, and hollowing out of domestic capability” as key factors in manufacturers’ struggles with disruption. Solutions might involve diversifying suppliers, finding factories that are closer to home, and utilizing data analytics to enhance transparence and operational insight. (It always comes back to data, doesn’t it?)

Bonus trends

Consolidation: On the executive side of things, there’s something else we’re seeing on the horizon: mergers and acquisitions. As the economy makes is slow but steady recovery after 2020, private equity companies are looking to invest in and consolidate manufacturers across the country. What exactly that means for the shape of the manufacturing world this year is a little unclear, but it’s undeniably something to look out for.

If you’re interested in finding out more about trends in manufacturing, or in learning more about how an incentive program can benefit your business in changing times, book a meeting with an incentive expert.

Going green: sustainable manufacturing practices are becoming increasingly popular. According to Forrester, industries with major carbon footprints will be looking into how to reduce their impact on the environment. Deloitte similarly notes an increased focus on environmental, social, and governance (ESG) factors within the manufacturing sphere, which prioritize sustainable business practices.

Conclusions: Manufacturing Outlook Uncertain?

Even as many sectors are looking towards the future with a sense of cautious optimism, it seems like leaders in manufacturing are still holding their breath. It’s going to be a long climb back to pre-pandemic levels of prosperity, but business leaders are ready to take up the challenge, and may even be able to innovate their practices in ways that will make them even stronger moving forward.

Data analytics and enhanced “smart” tech in shop floors allow manufacturers to adapt more quickly and smoothly to market volatility and changing end user tastes. There will always be new challenges that arise within a given industry as time goes on. But there are steps manufacturers can take to help move their employees, channel, and product into the new Industrial Revolution.

Worried about communicating the technological complexities of your product? Consider setting up a channel enablement program with your distributors. Or maybe you’re thinking about adopting the DTC model—consider how an incentive program can give valuable insights into end users’ buying habits.

If you’re interested in finding out more about trends in manufacturing, or in learning more about how an incentive program can benefit your business in changing times, book a meeting with an incentive expert.