If you’ve had the chance to look over HMI’s recent market research report on contractor buying patterns, you’ll already be familiar with the key takeaways: channel erosion is happening, buyers are turning increasingly to digital tools, and they’re increasingly expecting smooth, speedy, convenient service.

But that’s just the general picture – what happens when we take a closer look? HMI sought respondents from a variety of B2B industries, such as electrical, plumbing, HVAC, building materials roofing, and landscaping. Filtering the data through respondents’ industries, we realized that each one had a different story to tell. In today’s article, let’s dive into the world of roofing to see what distributors can learn from contractor preferences.

So, who exactly are we talking about here?

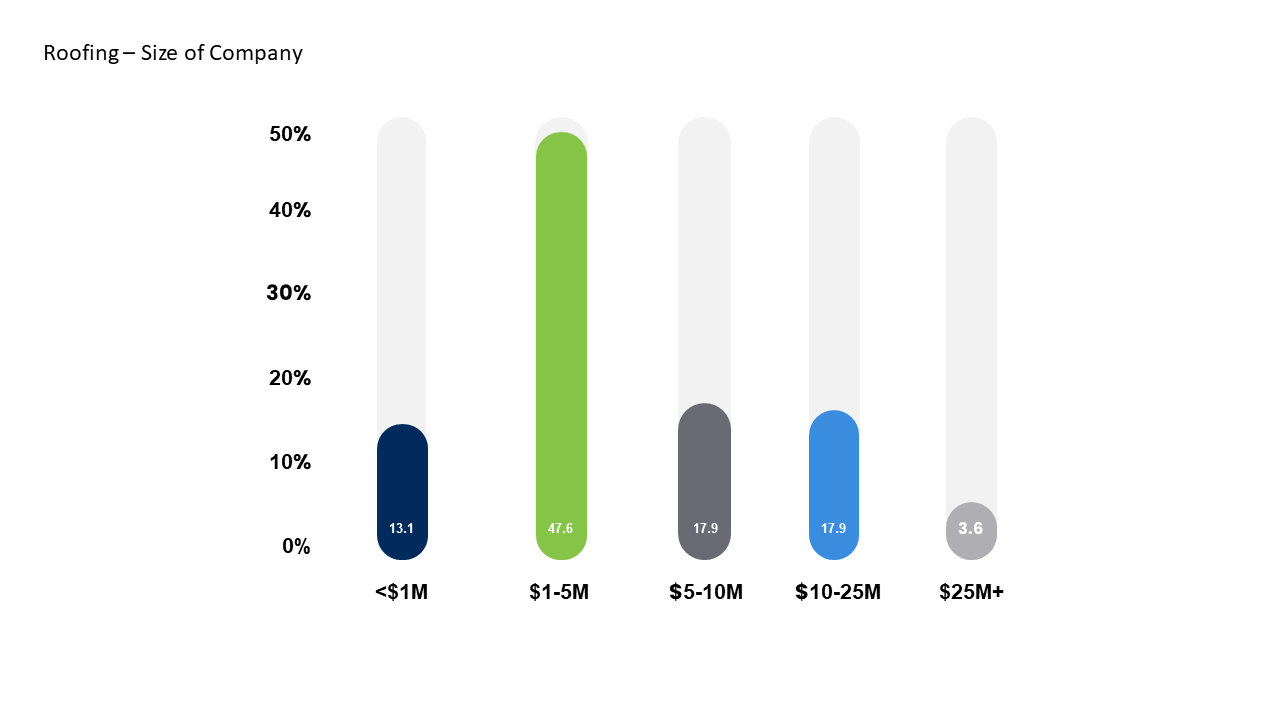

Although we’re specifically looking at respondents in the roofing industry, it’s important to note the ways they differed from the bunch. Our roofing respondents came from relatively larger companies in general. Only about 6 percent of overall respondents came from companies earning between 10 and 25 million, while about 18 percent of those in roofing said the same. On the flip side, a large portion (about 37% of overall respondents) earned less $1 million, while for roofing that number was only around 13 percent.

Respondents from roofing companies were also far less likely to be the owner or president of their company – around 53 percent, compared with the overall percentage of owners and presidents (72 percent). Two pictures emerge here: the average respondent regardless of industry is an executive decisionmaker at a fairly small company, while the average roofing respondent is relatively more likely to be a mid-level team member at a larger company.

Roofers keep it old school

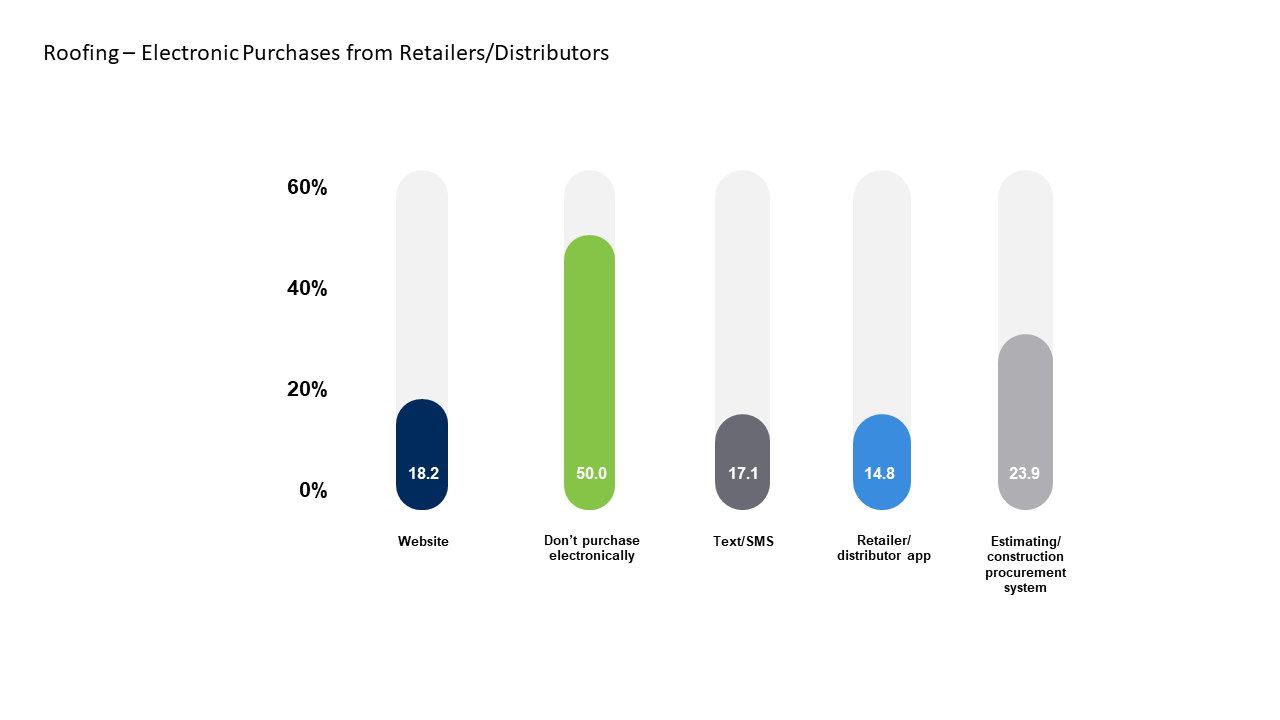

While we discovered that HVAC was ahead of the game when it came to adopting digital eCommerce strategies and technologies, our data shows that roofing has in general been far slower to enter the Fourth Industrial Revolution. This is most noticeable in their responses to being asked how they prefer to electronically purchase material from their distributor partners.

Where the largest share (42 percent) of overall respondents said they prefer to use a website, only 18 percent of roofing contractors said the same. They were more likely to prefer purchasing through an estimating or construction procurement management system (about 24 percent versus 10 percent) but overall less likely to use electronic purchasing methods at all: 50 percent of roofing contractors said they don’t purchase electronically, compared with 37 percent overall.

The roofing channel holding (relatively) strong

In our one of our analysis articles of the market research report, we noted the erosion of the traditional sales channel: contractors are increasingly buying from a multiplicity of places: multiple distributors, online-only retailers, or just straight from the manufacturer.

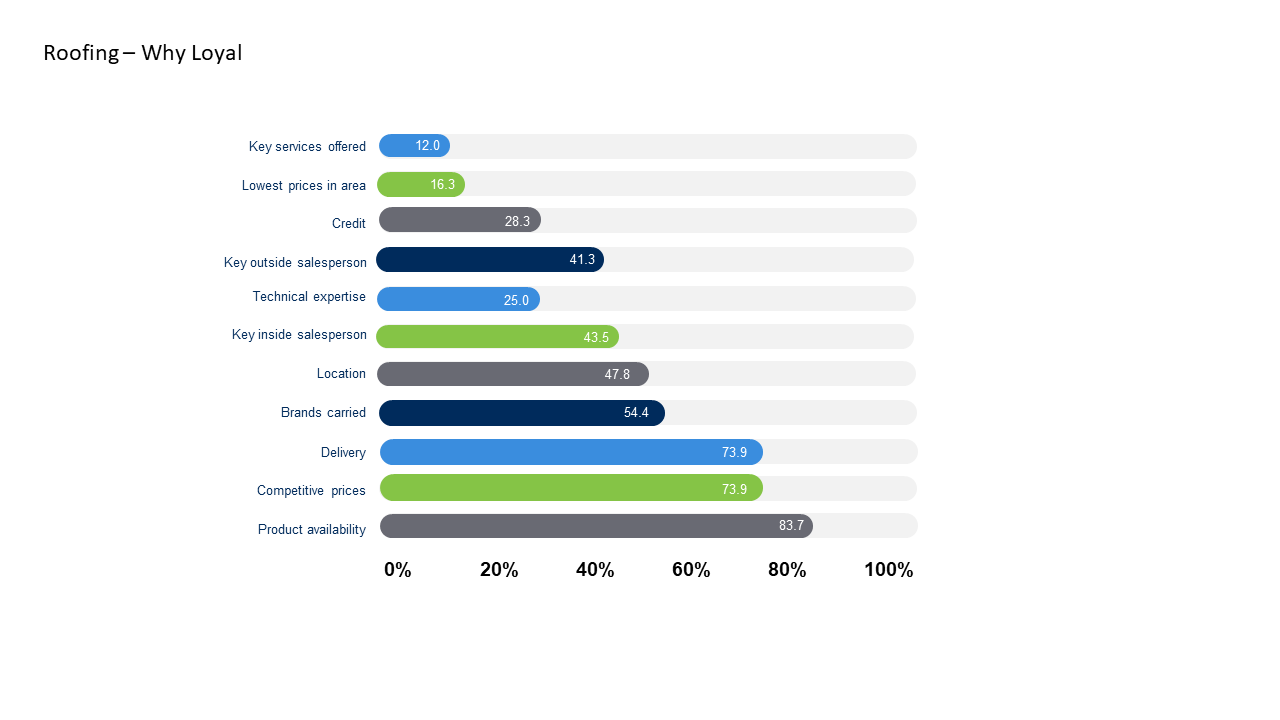

The roofing picture is a bit more traditional, though. Around 49 percent of roofing contractors said that they never use online-only retailers to purchase material, as opposed to only about 34 percent in general. Roofing contractors on average also preferred to work with fewer distributors: our respondents in roofing purchased from an average 2.97 distributors, while the overall average was 3.5. When asked about key drivers of loyalty, roofing contractors were far less likely to say that technical expertise was important (25 percent, compared with around 49 percent overall) and more likely to highlight having delivery options and competitive prices (both of which stood at 74 percent versus 62 percent overall).

So, roofing is in many ways more old-school than some of its brethren in the B2B sphere. Even though the roofing contractors we heard from were on larger on average, it seems they generally still prefer to stick to the practices that have worked for decades.

Distributors of roofing materials should, however, take note of the ways roofers are looking to use digital resources. For example, about 23 percent of respondents in the roofing industry shared that when they do use distributor websites, they use it for reviewing or downloading their invoices. (Which only about 9 percent of overall respondents marked as important). Being a savvy modern business leader isn’t just about racing to adopt new strategies and technologies as quickly as possible – it’s about anticipating the needs of your partners or potential partners and creating the optimal buying experience.

Incentives: the untapped potential

Finally, around 64 percent of roofing contractors shared that they would be more likely to buy from a distributor with an incentive program, compared with 53 percent across all industries. Since roofing contractors appear mostly to prefer doing business offline and with a slightly lower number of distributors, distributors have an opportunity to lean into the advantages that incentive programs can bring. Whether it’s building a sense of loyalty, edging out the competition, or increasing revenue, incentives offer a host of opportunities for growth – for both the contractor and distributor – whether you prefer the digital world or the analog one.

Conclusion

Remember: just because roofing isn’t as interested in going digital as other industries are at the moment doesn’t mean you don’t have to think about change or innovation. Are you anticipating all of your buyers’ needs? Are you meeting expectations or exceeding them? Are you fruitlessly pushing them to get online, or are they looking for opportunities to move into the digital world that you’re not providing them? Paying close attention to your contractor’s expectations and wants allows you to stand out among the competition. Because while roofing is still in some ways sticking to traditional forms of doing business, that doesn’t mean it will always be that way.

Want more insights on B2B contractor buying behaviors and preferences? Check out HMI’s recent webinar on our research or download the whole report.